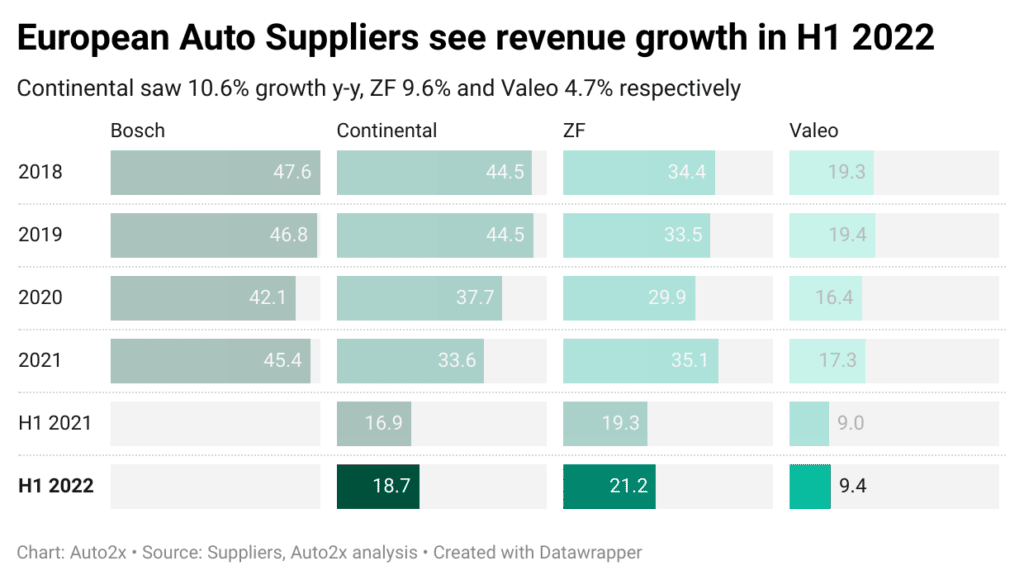

Most major European Auto suppliers saw revenues rebound in 2021 but the ongoing war threatens further recovery to pre-COVID figures

Auto Suppliers Bosch, Continental, Valeo and ZF posted higher revenues in 2021 despite the European market slowdown.

This comes after a turbulent 2020 that saw the whole automotive industry shrink as the coronavirus pandemic compounded the transformational challenges players face.

The slowdown in vehicle sales in Europe was offset by a strong order book and new products in ADAS, software, electrification among others as auto suppliers move to software-defined vehicles and mobility services, Auto2x

European Auto suppliers see revenue growth in H1 2022, Auto2x[/caption]

European Auto suppliers see revenue growth in H1 2022, Auto2x[/caption]

Bosch

In 2021, Bosch’s revenues bounced back by 10% to €78.8 billion after a turbulent 2020 that saw the whole automotive industry shrink as the coronavirus pandemic compounded the transformational challenges players face.

Bosch’s Mobility Solutions division, i.e. ex-Automotive Technology, includes the company’s ADAS business. It accounted for 57.6% of Bosch’s revenues in 2021, down from 60.3% in 2018, and it is benefiting from a broader push to make vehicles more intelligent.

Continental

Hanover-based Continental, the world’s second-largest automotive supplier by revenue behind Robert Bosch, saw sales drop by 15.0% in 2020 to €37.72 billion. The company’s Automotive Group accounted for 60.4% of total revenue in 2018 or €26.84 billion, an increase of over €26.73 billion in 2017.The Continental Group is organized across three business areas:

- Automotive Technologies: includes the Autonomous Mobility & Safety (AMS), formerly known as Chassis & Safety, and the Vehicle Networking & Information segment. Continental’s Advanced Driver Assistance Systems (ADAS) is one of the four Business Units of the Autonomous Mobility & Safety (AMS) segment.

- Tires (or Rubber Technologies)

- ContiTech (ex Powertrain Technologies)

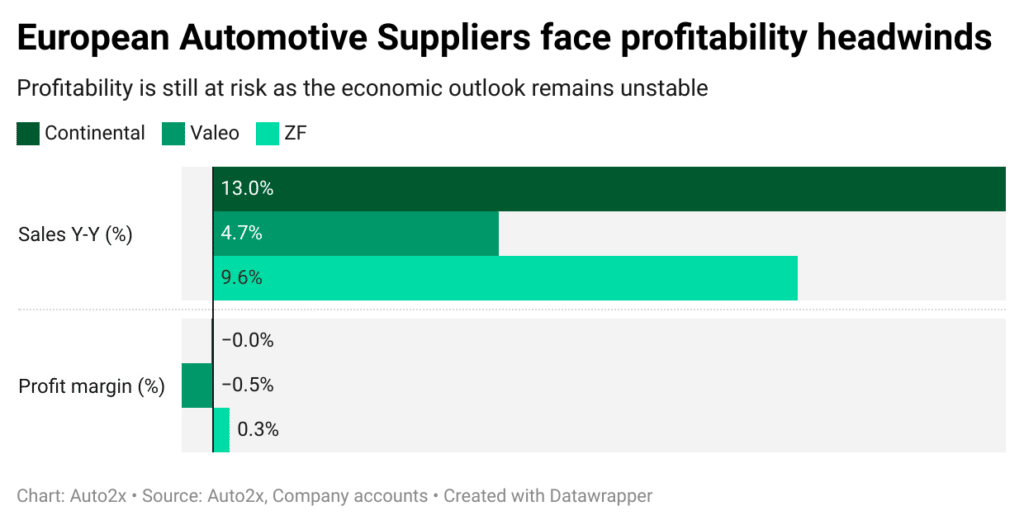

Continental’s Q2 2022 sales grew 13% y/y to $9.62 billion. The company’s Q1 revenue rose 8.2% y/y to $9.79 billion.

ZF

ZF surpassed Continental in 2021 by automotive revenues reaching €35.1 billion, up from €32.6 billion in 2020. ZF’s Commercial Vehicle Technology division saw strong growth, similar to Electrified Powertrain and Car Chassis.

ZF Friedrichshafen AG manufactures and develops transmission systems and components, driveline and chassis technology, electronics and sensors primarily for passenger cars and commercial vehicles. ZF provides products and integrated solutions in the fields of mobility, transportation and autonomous driving.The business units are assigned to the following seven divisions: Car Powertrain Technology, Car Chassis Technology, Commercial Vehicle Technology, Industrial Technology, E-Mobility, Aftermarket and finally Active & Passive Safety Technology. Since Jan’19, the 3 divisions Electronics & ADAS, Passive Safety Systems and Actively Safety Systems will be considered separately in reporting.

Auto Suppliers benefit from the rise in car sales: 11.96 million car sales in Western Europe in 2021

Car sales in Western Europe grew by 1% in 2021 year-on-year, mainly due to the impact of the semiconductor shortage that negatively impacted car production in H2 2021.

ACEA

To learn more about the outlook of Automotive Suppliers in ADAS and Autonomous Driving, read our reports.