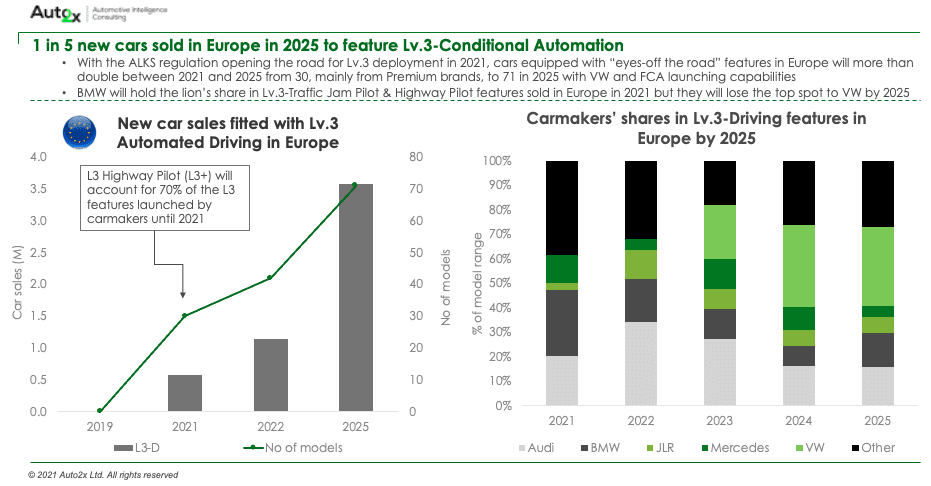

With the ALKS regulation opening the road for Level 3 deployment in 2021, and Autonomous Driving roadmaps largely insulated from the pandemic, “eyes-off the road” technology will be commercialized in Europe and Japan this year

Cars equipped with Level 3 features in Europe will more than double between 2021 and 2025 but hands-off functionality will be restricted to highway functions due to regulation and Lidar deployment strategies

Premium car brands, such as Audi, BMW, and Mercedes-Benz will dominate deployment of Level 3 – Driving features in 2021 but by 2025 Volume brands will lead both market shares in Lv.3 sales and models equipped with Level 3 capabilities

BMW will hold the lion’s share in Level 3 – Traffic Jam Pilot & Highway Pilot features sold in Europe in 2021; VW the claim the top spot in 2025

Regulation delayed the transition to Level 3 “conditional eyes-off” from 2017 to 2021

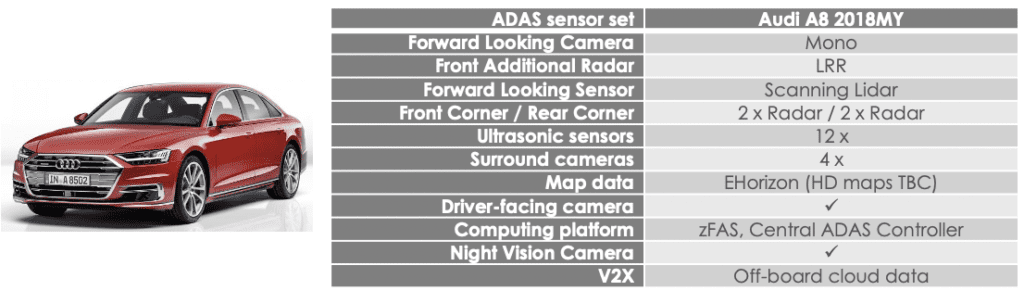

Technologically, 2017 was the year of transition from Partially (SAE Level 2) to Conditionally-Automated driving (SAE Level 3) in passenger cars, with Audi becoming the first to announce a Level 3 Driving feature, the AI Traffic-Jam Pilot in the 2018MY A8. But with regulation restricting the deployment of “eyes-off-the-road” on private car ownership, Level 3 introduction is delayed by more than 3 years until later in 2021 in Europe when the Automated Lane Keeping Systems regulation comes into force in the signatories the UNECE R.79.

Europe is not the only geography to see Conditional Automation in 2021 with Nissan and Honda announcing deployment plans in Japan. Nissan’s ProPilot 2.0, which the company originally planned to launch in Japan by the end 2019 in the Nissan Skyline, falls into the definition of L3+ Highway Pilot. What’s more, Changan is among the Chinese carmakers planning to start of production of Lv3 autonomous cars in the world’s largest car market this year.

Read more about China’s potential to read the Autonomous Driving race here.

Autonomous Driving roadmaps could remain insulated from the pandemic but further collaboration is needed

Despite the disruption the automotive industry has witnessed due to the pandemic, the Autonomous Driving roadmaps of some carmakers remained largely unaffected driven by safety regulation, market competition. Mercedes-Benz, BMW, Nissan, and Honda are among the carmakers announcing a shift to Level 3 from 2021. What’s more, back in May 2020, Volvo confirmed its commitment to self-driving cars as they remain a priority for the Swedish OEM. Volvo plans to launch a Lv.4 system from 2022 featuring Luminar’s lidar.

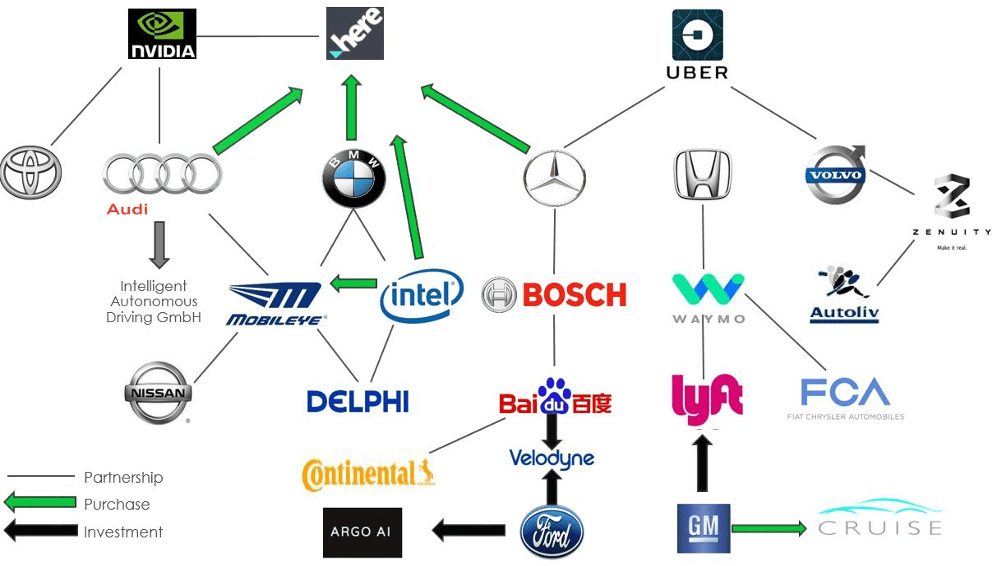

The capital constraints together with the need for further expertise in AI and software to accelerate time-to-market will fuel further collaboration between players.for example to develop AD platforms. This shift from working independently to a collaborative approach is demonstrated by recent announcements of the alliances between leading car manufacturers and major ADAS Suppliers or mobility providers.

Read more about the most important technology partnerships between carmakers and other automotive players in 2020.

“We expect that in 2025, 21.2% of new car sales in Europe will offer Highly-Automated Driving (Level 3) features as optional or standard equipment. Even though the majority of Lv.3 features will come from premium car manufacturers in 2021, by 2025, Volume OEMs will account for the lion’s share.

The functionality of Lv.3 features will quickly expand from low-speed, single-lane Traffic Jam Pilots to more advanced Highway Pilots supported by Lidar.”

Auto2x

Premium car brands will dominate Level 3 deployment until they start shifting to Level 4 from 2022

Premium car brands, such as Audi, BMW, and Mercedes-Benz will dominate deployment of Lv.3-Driving features in 2021 but by 2025 more Volume brands will launch capabilities. BMW will hold the lion’s share in Lv.3-Traffic Jam Pilot & Highway Pilot features sold in Europe in 2021 but they will lose the top spot to VW by 2025.

BMW plans Level 3+, Level 4 capable vehicle by 2021, announced as ‘iNext’ back in Sep’18 or iX in Nov’20, developed through the partnership formed with Mobileye and Intel in July 2016. iX will act as a tech flagship for BMW with 100% BEV and leading AD for the brand. The German brand formed partnerships for solid-state Lidar with Innoviz for its L3/4 platforms through Magna as a Tier-1. We assess that L3 will expand quickly across BMW’s carlines between 2021 and 2025 so that by 2025 L3 will be available in 52.4% of BMW’s model range, or 11 models out of the 21 models.

ADAS content is increasing to bridge the technological gap for higher levels of autonomy

Auto2x expects that leading ADAS players will introduce 71 Level 3 -equipped vehicles in Europe in 2025 while Level 3 penetration will reach 21.2% of new car sales in Europe in that year.

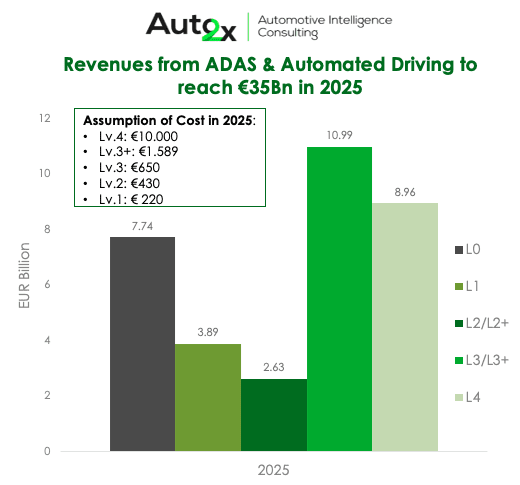

A higher level of vehicle automation will require an augmented sensor set, new architecture, and innovative validation methods among others. In more detail, ADAS Average Content per Vehicle in 2020 will range from €489 for Level 2, with 17 sensors per car, to €960-€2.100 for Level 3 depending on the usage of lidar or not for redundancy.

Level 3 could cost €3.000 & Level 4 €10.000

APTIV

This will drive demand for ADAS sensors, supercomputers, AI, high precision maps, etc. It will also drive further collaboration between OEMs and Tier 1s-2s for the development of AD platforms-be it Level 4 for car-sharing or not. Volume OEMs, as well as AD laggards, are also in demand for cheap and scalable AD platforms in their quest to remain relevant.

Read more

- Top-12 technology partnerships in Connected & Automated Driving in 2020

- TOP-5 new changes in 2021 transforming Autonomous Driving

- Top 3 reasons why China could win the Autonomous Driving race

- New Regulation for Lv.3 Autonomy finally coming in 2021 after 3 years of delays

- Highly-Automated Driving (Level 3) in 1 out of 6 cars in Europe in 2021, says Auto2x

Read our reports to understand carmakers’ strategies to reach higher levels of vehicle autonomy and the opportunities they create for ADAS sensors, AD platforms as well as collaborations. Our reports also provide in-depth analysis of how the regulatory framework affects OEM strategy for Level 3 deployment.

- 30 Carmakers’ Roadmaps in Automated Driving up to 2025.

- ADAS Suppliers Rankings & market shares 2015-20