Description

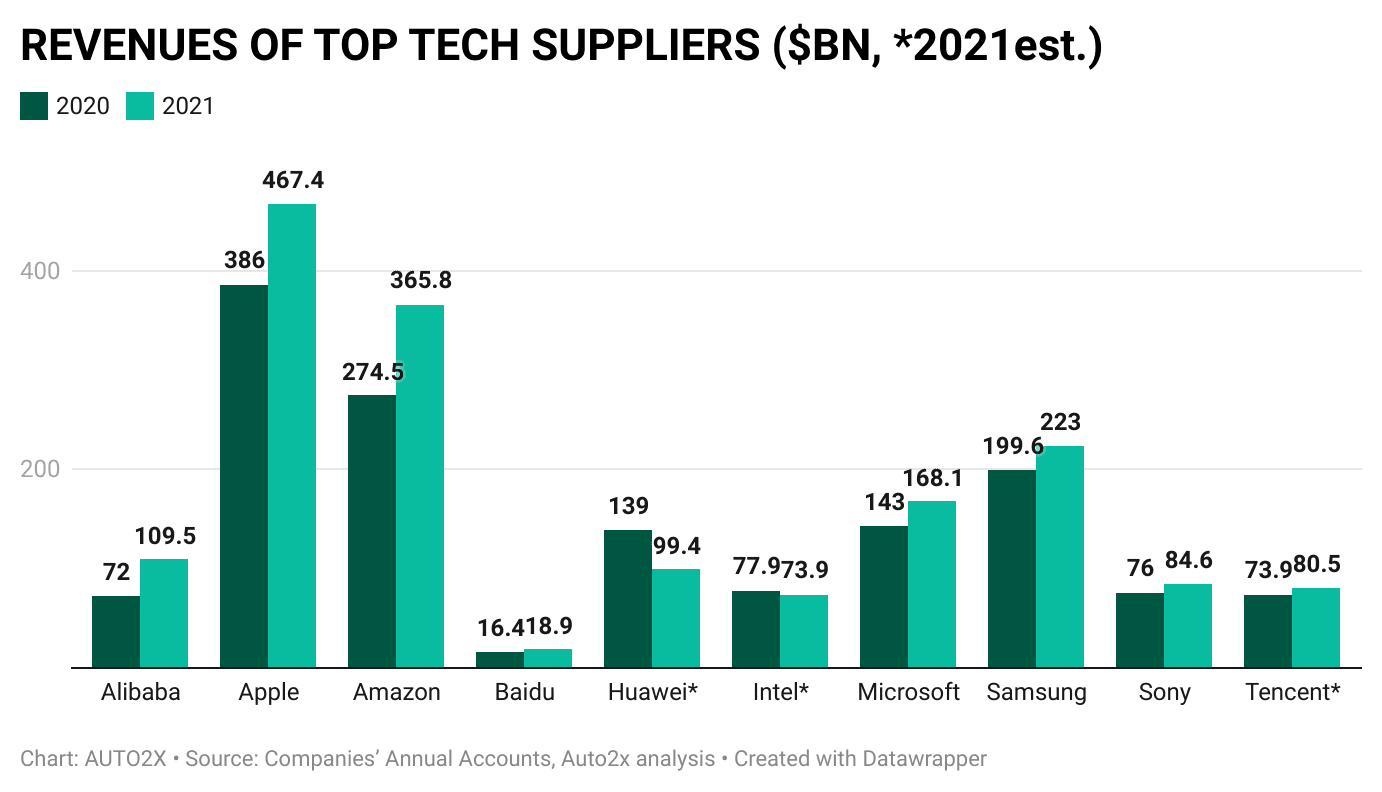

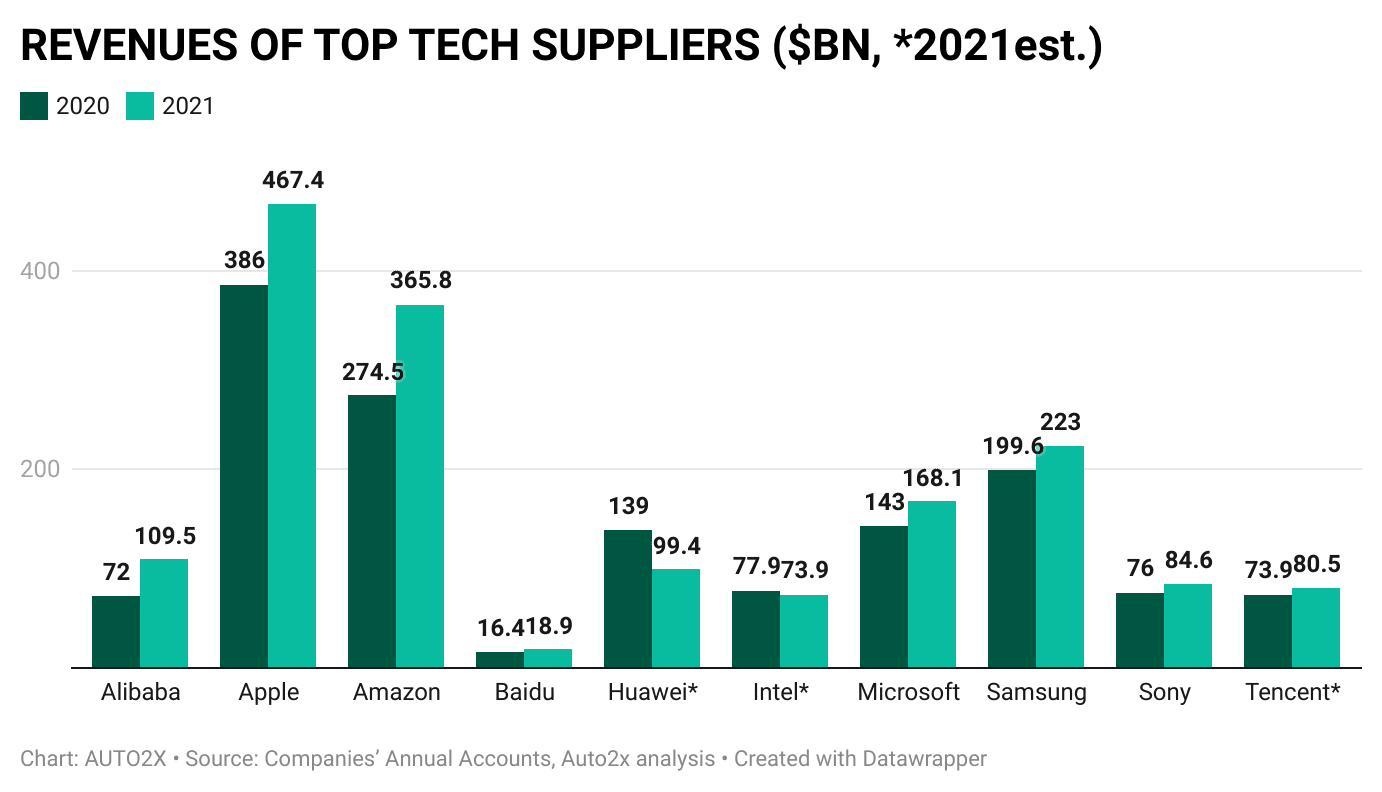

The world’s biggest Tech Companies, including Amazon, Apple and Microsoft, together with Chinese Majors Alibaba, Baidu, Huawei and others, are expanding their presence in the automotive industry to monetize the capability gap of existing Tier-1s in Software, AI, and data needed for Autonomous Mobility. They are also supporting the digitalization transformation of major carmakers and suppliers.

As the value creation in Mobility shifts from hardware to software, this expansion threatens major Tier-1 Suppliers Bosch, Continental and others, who still maintain the lion’s share in the radars and cameras for ADAS, but need to transform quickly to the needs of Autonomous Mobility to maintain their position in the market.

This report examines the capabilities of the 10 biggest Tech Companies in Autonomous Driving and their potential to capture a share in rising new business models in Autonomous Mobility.

- Alibaba

- Amazon

- Apple

- Baidu

- Huawei

- Intel

- Microsoft

- Samsung

- Sony

- Tencent

Tech Companies are building capabilities to become the new, core Suppliers of Autonomous Driving

- Alibaba – the Chinese e-commerce giant – has formed an EV joint venture with SAIC, while Didi Chuxing – the Chinese ride-hailing provider – has partnered with automaker BYD in D1 development – an electric vehicle specifically designed for ride-hailing services. Cooperation between carmakers, high-tech companies and telecommunications service providers has spawned a number of startups, which have already offered experimental services in cities including Beijing, Shanghai, Changsha and Hunan.

- Baidu expects to supply self-driving system Apollo to 1 million cars in 3-5 years

- Huawei has recently launched new products in Autonomous Driving focusing on ADAS sensors (4D imaging radar), HMI (AR-HUD) during their product launch titled ‘Focused Innovation for Intelligent Vehicles’.

- Samsung Electronics will work together with Tesla to develop chips for their next-gen HW 4.0 for autonomous driving.

Read our report to understand how the products and services of Tech Companies and their outlook in the Autonomous Driving market.

To learn about the outlook of today’s major Tier-1 Suppliers of ADAS, including Bosch, Continental, Valeo and others, read our report: ADAS Suppliers Rankings & Market Shares.

Key opportunities for Tech Companies in Autonomous Driving

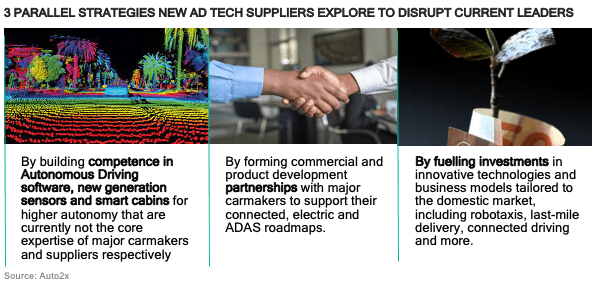

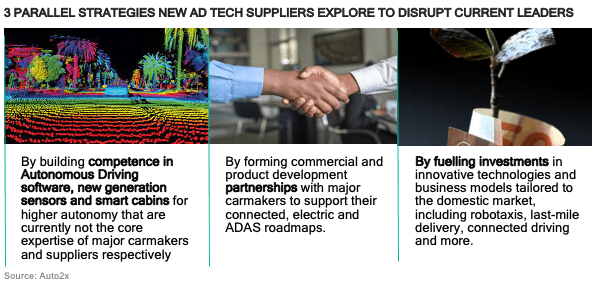

We identify a number of opportunities for Tech Companies to enter or disrupt the existing supply chain.

- Next-gen Perception Hardware for Autonomous Driving: imaging radars, advanced cameras and lidar for L3-5 Autonomous Driving

- Software: chips for Autonomous Driving

- AI: From AI for AD to AI for HMI such as in-car AI assistants

- Data-based Mobility Business models such as in-car e-commerce

- Connectivity: 5G, Connected Infrastructure and Smart Cities

- Autonomous Shared Mobility: AMoD / robotaxis, autonomous deliveries

TABLE OF CONTENTS

Executive Summary

- The Competitiveness of New Tech Suppliers across Technology, Strategy and Market

- The major opportunities for Tech Giants to disrupt current Tier1s in Autonomous Driving

- New Sensors for L3-4, Supercomputers & Software are becoming new battlefronts

- Learn how new Tech Suppliers aim to monetize their expertise in AI and Software

- Amazon and Microsoft benefit from the need for Cloud-based development of ADAS

- Rising competition for new revenue pools from Robotaxis & Autonomous Deliveries

- Chinese Tech-giants bet on the smart car-hailing revolution

- Key Collaborations between New AD Tech Suppliers & Carmakers

- Key Collaborations of New Tech Suppliers in Autonomous Driving with other players

- Key Collaborations between Chinese Suppliers & Carmakers in ADAS

- Chinese ADAS Suppliers are fuelling an investment boom in autonomous & shared Mobility

- Summary of Core Competence and product portfolio of Tech Giants in Autonomous Driving

- Alibaba

1.1. Alibaba’s Products and client base in ADAS and Automated Driving

1.2. Investments in Autonomous and Shared Mobility

1.3. Assessment of Readiness in Autonomous Driving

- Amazon

2.1. Portfolio in Mobility: AWS, Autonomous Deliveries

2.2. Investments in Mobility

2.3. Opportunities for Amazon: In-car e-commerce paired with ride-hailing or autonomous deliveries

2.4. Assessment of Readiness in Autonomous Driving

- Apple

3.1. Apple’s Ambition in Electric & Autonomous Cars

3.2. Apple’s Investments in Mobility

3.3. Current offerings & Recent activity

3.4. Assessment of Readiness in Autonomous Driving

- Baidu

4.1. Baidu’s Portfolio of Products and Services in Autonomous Driving

4.2. Baidu Apollo. 33

4.3. Testing Robotaxis in China and California. 33

4.4. Baidu is building Smart City Infrastructure. 34

4.5. Collaborations with Chinese carmakers in ADAS. 34

4.6. Investments in Autonomous and Shared Mobility. 35

4.7. Assessment of Readiness in Autonomous Driving. 35

5. Huawei

5.1. Expertise in ADAS and Portfolio of ADAS Sensors and Features

5.2. Collaborations with Chinese carmakers in ADAS.

5.3. Assessment of Readiness in Autonomous Driving

6. Intel

6.1. Intel’s Mobileye

6.2. Mobileye’s ADAS revenues and portfolio

6.3. Mobileye’s partnerships in ADAS

6.4. Assessment of intel’S Readiness in Autonomous Driving

- Microsoft

7.1. Microsoft’s ambition in Mobility

7.2. Current Offerings: Automotive Cloud Microsoft Azure

7.3. Partnerships with OEMs

7.4. Assessment of Readiness in Autonomous Driving

- Samsung Electronics

8.1. Samsung’s plans in Autonomous Driving

8.2. Samsung’s Investments in Mobility

8.3. Current Product Portfolio and Recent Activities

8.4. Samsung’s Commercial Partnerships with OEMs

8.5. Assessment of Readiness in Autonomous Driving

9. Sony

9.1. Sony’s Product Portfolio in Autonomous Driving

9.2. Assessment of Readiness in Autonomous Driving

- Tencent

10.1. Tencent’s products in Autonomous Driving

10.3. Collaborations with German Carmakers

10.4. Investments

10.1. Assessment of Readiness in Autonomous Driving