Description

Automotive Cyber Security Market Forecast

By 2030, vehicle security will expand to cover cyber threats on the vehicle as well as the vehicle’s external network including the infrastructure. Therefore, effective Automotive Cyber Security requires cross-industry collaboration

In the aftermath of the car hacks by cyber security researchers and US Senator Markey’s report on the vulnerability of modern vehicles to malicious attacks, Automotive Cyber Security will unfold as the key topic in OEMs and suppliers’ agenda for the immediate future.

The outcome of these drivers will be a shift in car manufacturers’ strategy towards Automotive Cyber Security in the form of new investment, M&A and collaborations with suppliers and other cyber security companies. This could drive Connected-Cyber Security penetration up quite quickly and alter the competitive landscape.

The key challenges here are how quickly the level of security and privacy in Connected Cars will rise to sufficient levels to avoid having vulnerable vehicles.

We expect that the landscape of the Automotive Cyber Security market will change rapidly by 2030, especially after the expected mandate for standard fitment of cyber security solutions. Regulatory mandates on the standard fitment of cyber security solutions in modern vehicles will be the catalyst that will drive change in the competitive structure as competition intensifies and consolidation continues.

“We assess that towards the end of the forecast all new cars will feature some kind of ratings indicating how strong their security against cyber threats is, together with their ratings for safety”

Auto2x

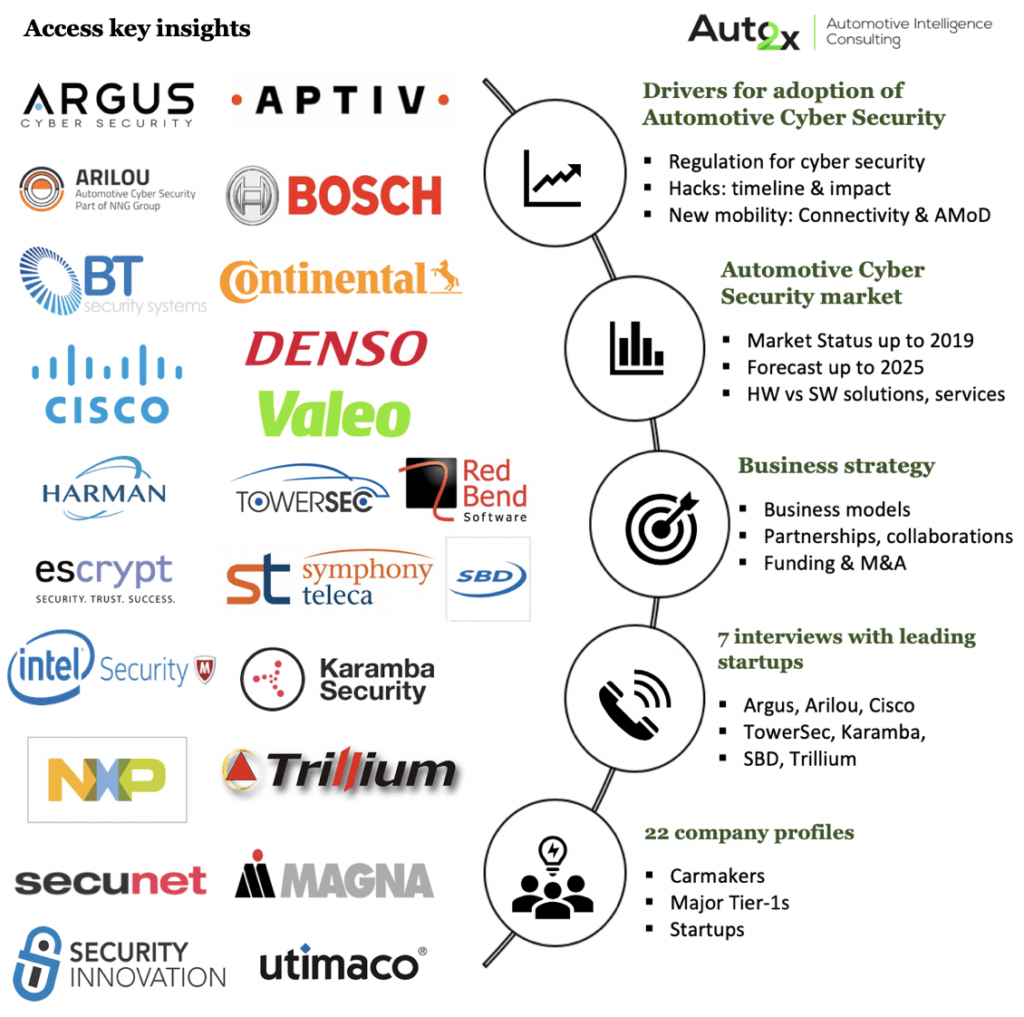

Read our report to:

- Unlock the potential of the Automotive Cyber Security market by reading about investment, M&A, partnerships in the marketplace

- Discover the drivers of growth over the next decade

- Read our penetration forecast of Hardware, Software-based solutions and Services

- Identify the leading suppliers of software and hardware equipment

- Understand the competitive landscape by reading our exclusive interviews

- A-Z: software, hardware solutions and service portfolio from leading companies

The white-hat hacking demonstrations will probably accelerate the outcome of the regulatory mandate in the U.S and pave the way for other countries to follow. Additionally, most of the currently ongoing or announced penetration tests will have finished, similarly to product evaluation for most OEMs. Therefore, talks about product integration will begin for their next-generation vehicles. This will fuel demand for both software/hardware solutions and services for Automotive Cyber Security over the next decade.

Additionally, more and more carmakers announce their intention to introduce OTA updates which, although most of them today serves more convenience purposes rather than security ones, it brings them one step closer to the task. As more carmakers exploit the benefits of the cloud, i.e. data storage, remote vehicle control and wireless updates, demand for cloud security is expected to increase.

The necessity for industry-wide standardisation and collaboration is key for adoption. However, we expect that the regulation will set minimum standards in the form of a basic framework, on top of which carmakers will develop their solutions to help them in competitive differentiation.

What is more, the history of the automotive industry is full of examples of lack of collaboration and unwillingness to standardise procedures for innovative technologies on behalf of the OEMs (e.g. EV charging). Therefore, even though some common, voluntary standards will emerge, it is somehow unrealistic to expect them to cooperatively increase vehicle security unless the regulation demands so or a malicious car hack occurs-given fact that it constitutes an additional cost.

Demand for solutions is in its infancy despite increasing supply

Argus Cyber Security, which was acquired by Continental, offers an Intrusion Prevention System uses Deep Packet Inspection (DPI) algorithms to detect hacking attempts and prevents them from affecting a vehicle’s critical systems. It also notifies car manufacturers in real-time when these attempts are happening and enables seamless integration into any vehicle’s production line. The company also offers Cyber Security Vulnerability assessments.

Network giant Cisco offers both services and software solutions in the Automotive Cyber Security market. In terms of the latter, Cisco offers the Auto Guard, a holistic security solution for vehicles which includes anomaly-detection, hardening and other Vehicle Area Network security functions. The solution is also set to extend to offer real-time, over the air updates for vehicle ECUs.

Israel-based Arilou Technologies offers cyber security solutions in the fields of car cyber security (CAN bus), hacking and penetration testing. Apart from conducting Cyber Security Vulnerability assessments, the company has developed the Security Agent, an IPS and CAN bus firewall that can be integrated into the existing vehicle’s CAN network and blocks any attempt to send illegal messages on the network.

|