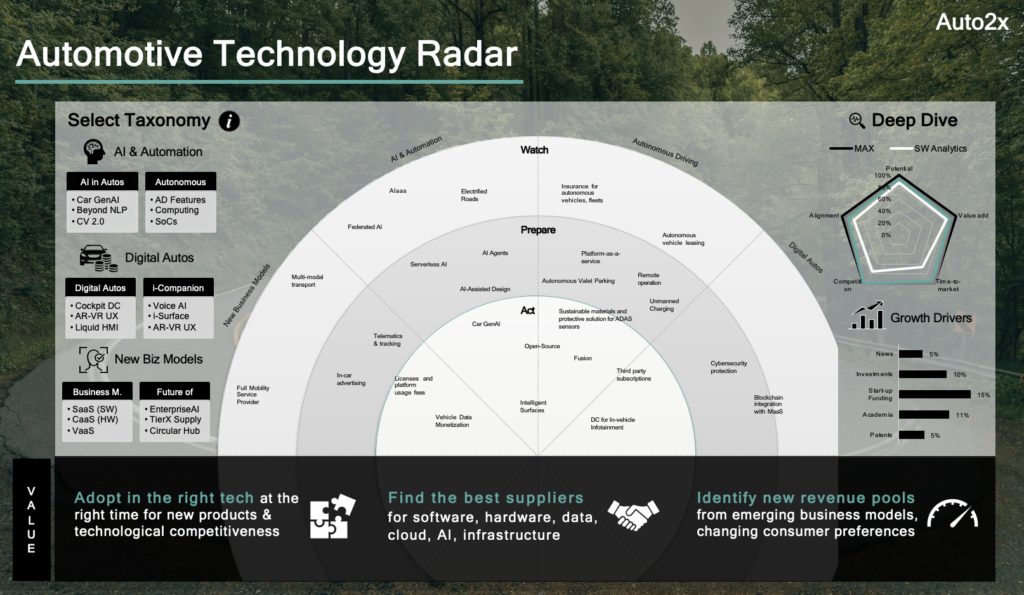

Automotive Technology Radar: Act-Plan-Watch

The Auto2x Automotive Technology Radar empowers technology scouting, partner discovery and strategic planning with guidance on ACT-PLAN-WATCH across +1400 technologies in AI, Autonomous Driving, Connected Cars, Electrified mobility and New Business models.

The automotive industry is undergoing massive change driven by digital transformation, automation and energy transition. New business models, incl. data monetisation, shared mobility, and circular strategies, could add another $1 trillion to Automotive Revenues by 2030.

Change creates tremendous opportunities, as demonstrated by the waves of new market entrants, such as tech giants, and the proliferation of start-ups, among other indicators.

The Auto2x Automotive Technology Radar helps you scout and invest in opportunities with the highest market potential, business readiness and technological maturity to:

- unlock new revenue pools,

- advance product development or help you innovate.

- find best-fit partners for commercial or technology development

The Automotive Technology Radar is a crucial tool to empower technology scouting, partner discovery, strategic planning and execution for Corporate Strategy, Innovation, New Product Development, R&D and Engineering teams.

Auto2x’s Radar covers +1400 technologies and uniquely synthesises:

- innovation metrics for incumbent and emerging technologies,

- business data: market sizing, market share, growth rates;

- and interviews with experts, such as CEOs, entrepreneurs and academics.

Deliverables

Online Access

Annual access to the Live Database for up to (3) individual users.

The Database is updated daily with new data and analysis. It covers the Radar Dashboard, the dataset and the methodology for our assessment.

You can download the data in Excel.

Presentation of Findings

Our authors will present the methodology and findings of the Tech Radar during a 1-hour online call.

There will also be an opportunity to answer your questions.

Additional calls for Q&A or scoping are available on-demand as a paid service.

Your updates

Monthly email digest with the most crucial updates of the month and why they matter to you.

You will receive 12 monthly email digests for your annual access.

Access to the Auto2x Newsletters.

Discounts for add-ons

Leverage exclusive offers for our industry and technology reports, databases and expert network to support your decision-making.

Learn more about our reports here.

New business models, incl. data monetization, shared mobility, and circular strategies, could add another $1 trillion to Automotive Revenues by 2030. Find the biggest opportunities with the Auto2x Automotive Trend Radar.

How does the Technology Radar work?

The basic principle is to develop a robust scouting methodology that captures technological disruption and market movements and prioritises the identified items into Act, Prepare and Watch.

- Act: These technologies or opportunities are your top priority when investing in or leveraging to build new products or find partners to enter new markets.

- Prepare: the action point here is to position yourself to take advantage of the upcoming development or emerging opportunity.

- Watch: the time horizon for these innovations or items doesn’t require immediate action.

We score each technology across 3 Parameters:

- Market Potential to show how big the market is, how fast it’s growing, what is the level of competition;

- Technological Maturity: Technology Readiness Level (TRL)

- Market Strategies which covers business readiness metrics

- Innovation teams can use the Radar to build insightful technology roadmaps and understand what new functionality or new products they can bring from the evolution of technology;

- Strategy teams can identify opportunities and prioritise them to allocate resources better and improve ROI.

- Investment and Venture Capital teams (VC) can use the Radar to scout for attractive investment targets, for example, finding start-ups operating in a segment with high potential that aligns with their investment thesis.

- Finally, the Radar also serves as an outside-in perspective to help shed light on your blind spots

Taxonomy: CASES and key technology clusters

Auto2x leverages a comprehensive taxonomy of more than 1400 technologies in Automotive, which allows you to deep dive into your area of specialisation.

- AI in Automotive: captures the impact of advancements in Computer Vision, NLP, Generative AI and other technologies on EVs, ADAS, etc.

- Connected Cars: the digitalization of the vehicle interior services, connectivity (5G-6G), Human Machine Interface (HMI) & Software-Defined Vehicles (SDV);

- Autonomous Driving captures hardware (sensors) and software, business models for cars, trucks, motorbikes, shared mobility and other use cases.

- New Business Models, such as component-as-a-service, data monetization, automated ride-hailing, electrified car-sharing, multi-modal transport;

- Electrified: Future of Powertrain, such as BEVs, PHEVs, HEVs, FC, clean ICE, Electric Vehicle charging, fuel cells, batteries, e-motors, and other;

- Circular Autos or Climate-Neutral Cars include sustainable materials, Circular Mobility, and sustainable manufacturing, among others.

Interested in learning more about the coverage?

- Use the Taxonomy below to discover the segmentation of technology.

- Do you want to find innovative companies behind these technologies? Follow the Taxonomy to see some listed players.

Artificial Intelligence Driving Automotive to the Future

40% of all working hours can be impacted with Generative AI trained by domain experts, because language tasks account for 62% of total worked time, according to recent research.

Who is leading Computer Vision innovation for Autonomous?

NVIDIA, Intel, Magna, Tesla are among the automotive players with the highest number of published patent filings in Computer Vision for Autonomous Driving in the US in 2023.

Patents filings grew with 12% CAGR between 2020 and 2022. The focus of innovation is on the reduction of computational complexity, fusion and simulation.

3 key use cases of Generative AI in Automotive and the challenges they face

- Design: Developers can utilize GenAi for simulation of scenarios and “edge cases”, thus improving efficiency and performance. However, the regulatory landscape is not ready to provide clarity and requirements for robustness.

- In-vehicle usage: Faraday Future’s FF 91 will feature the brand’s Generative AI Product Stack. Use cases include entertainment and social media. But, data quality, ethical guidelines and privacy policies are needed to filter out offensive or intrusive content.

- Personalized Mobility: by personalizing the passenger’s journey or traffic optimization. One of the main concerns is cyber security for these applications related to Intelligent Transportation Systems.

AI Assistants are expanding to Automotive and adjacent industries

AI Assistants are expanding beyond consumer electronics and vehicle infotainment systems to sales, marketing and engineering across multiple industries, including Healthcare, Sales, Messaging and Human Resources.

AI Assistants utilize innovations in Natural Language Processing, Generative AI and No-Code to improve customer interactions and enhance productivity by automating repetitive tasks.

Auto2x has identified 42 companies active in this space, Collectively, they have attracted $578 Million in funding.

Autonomous Driving Technologies and Opportunities to Act on

New ADAS features for better perception, customer experience, digital wallets and electric AVs will contribute €21 Billion by 2025 together with increasing sensor content.

Revenues from ADAS & Automated Driving will almost double between 2020 and 2025, from €14 Billion to €35 Billion due to the increase in sensor content and new customer features, according to our forecasts.

Top new ADAS features which hold strong potential to add value to customers and create new revenue pools for carmakers and suppliers include:

- Level 4 Autonomous Driver DNA that reflects the brand’s unique driving characteristics in the automated driving mode.

- Level 4-5 Autonomous Guardian for enhanced safety, e.g. tele-operation for safe maneuvers in city or highway scenarios;

- Acoustic Traffic Monitoring: Understands machine noises, road signals to support blind-spot monitoring and real-time analytics.

- Self-charging autonomous electric cars. The Level 3/4 – capable vehicle navigates autonomously to the EV charging station in a private parking space or Lv.4-Valet Parking Garage.

- Web3 applications such as digital wallets for AVs or NFTs, such as vehicle history with NFTs in Alfa Romeo Tonale. In the future, they can extend to SOTA for ADAS and blockchain payments with digital IDs for autonomous vehicles.

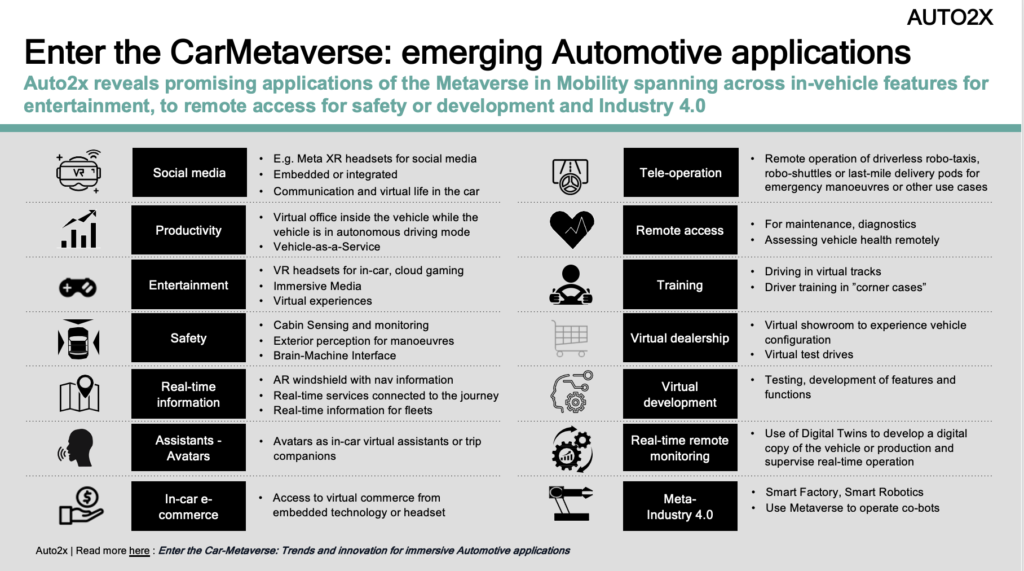

- Promising applications of the Metaverse span across remote access for safety or feature development and Industry 4.0.

Opportunities in Connected & Digital Autos

Opportunities in Software-Defined Vehicles for Electric Cars and Connected Driving

Next-generation Digital vehicles must integrate new, diverse technologies and complex logical operations; the hardware architecture has to support advanced software functionality and upgradability.

Software is the answer to the Digitization of the Automotive Industry but delivery is challenging. Learn about top innovation clusters across major technological building blocks of SDVs:

- EE Architectures: Assess the roadmaps of leading carmakers and suppliers in the development of centralized architectures and their partnerships;

- CarOS: Learn about the rising adoption of Google’s Android Automotive OS and the competitive offerings from MBUX and other players;

- Open-source software development

- Cloud: the emergence of automotive cloud as an enabler for cloud-based ADAS development, development of offerings from carmakers and the role of Microsoft, Amazon among others;

- Over-the-Air-updates and the opportunities for features-on-demand;

- Digital Twin

CarMetaverse: Hype or Disruptor?

The Metaverse, a part of the Web3, describes virtual worlds which provide immersive reality experiences for online communities powered by creators.

Car-Metaverse enables in-cabin features, remote access and virtual development for immersive-reality experiences powered by XR (VR & AR).

Learn about emerging applications, remote services and adjacent industry applications. Explore new business models and innovative companies behind core technologies, such as XR, holography, connectivity.

How to Monetise the Future of Electrified Mobility

Electrified Powertrains, Batteries and EV charging infrastructure

Three market forces are driving zero-emission powertrains: regulations, innovation in batteries and fuel cells and investments in Electrification, EV Charging & Hydrogen Mobility.

Electrification of passenger cars and commercial vehicles will play an important role in the journey towards a carbon-neutral society.

Batteries become the cornerstone of new business models in electrification. Battery-as-a-Service and Battery-Swapping emerge as new revenue pools.

Lithium-ion chemistry remains the most explored technology with research focusing on reducing cost per kilowatt and increasing energy density. Thus, technologies like advanced li-ion & Li-S are emerging, which shows improvements in energy density. Other chemistries such as Li-Air, etc. offer high potential, but it is too soon to validate their efficacy.

The Role of Hydrogen in Future Mobility

Hydrogen can be an important, safe, low-carbon transportation fuel, particularly for heavy-duty transport such as trucks, buses and shipping.

Hydrogen has a TAM of $185 Billion by 2026, while Fuel cells have $12 Billion.

Even though Hydrogen Mobility is still in its infancy, there is potential to lower the cost of hydrogen to €6/kg and commercialize Hydrogen ICE.

Emerging players in Hydrogen Mobility for Sustainability focus on reducing Hydrogen cost below $0.85/kg and scaling EV battery recycling

Alternate Fuels to save ICE

The development of alternative-fuel vehicles has been recognized as a promising way for emissions reduction from transportation.

Most heavy-duty vehicles are powered by diesel engines that emit high levels of particulates, nitrogen oxides, and other pollutants. Based on their mileage and fuel consumption, freight vehicles are among the highest contributors to GHG emissions and street-level pollution.

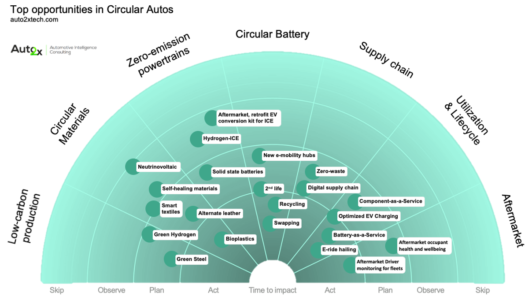

Circular Autos

Circular Autos represent a new vehicle class: carbon neutral, updatable and built from the ground up with renewable resources and embedded recyclability processes.

Auto2x identified key opportunities to accelerate the shift to Circular Mobility categorized across vehicle manufacturing, vehicle lifecycle and end-of-life.

These opportunities cover innovation clusters, strategies, and business models, based on market potential and technological maturity:

- Exponential technologies for Circularity, such as using computer vision to automate battery recycling, like Posh Robotics.

- Decarbonization of the ICE car parc with e-mobility aftermarket kits;

- Digital Twin and metaverse applications for Industry 4.0.

- 3D-Printed or decentralized EV manufacturing with micro-factories;

- Energy-as-a-Service solutions for smart grid integration of EVs

- Component-as-a-service, such as Battery-as-a-Service or swapping;

- Green Steel in Low-Carbon production,

- Bio-plastics in Circular Materials,

- and Aftermarket solutions for fleets are some of the top opportunities to pursue by market potential and time to impact.

How to assess technologies in the Trend Radar

We score each technology across 3 Parameters:

- Market Potential to show how big the market is, how fast it’s growing, what is the level of competition;

- Technological Maturity: Technology Readiness Level (TRL, e.g.

- Market Strategies which covers business readiness metrics

Discover innovative players behind emerging Technologies

Assess suppliers based on their:

- Market Positioning: Market share, Revenues, Client base

- Technological Readiness: Product portfolio, pipeline, innovation

- Strategy: Key announcements, Product Launches, Partnerships, M&A.

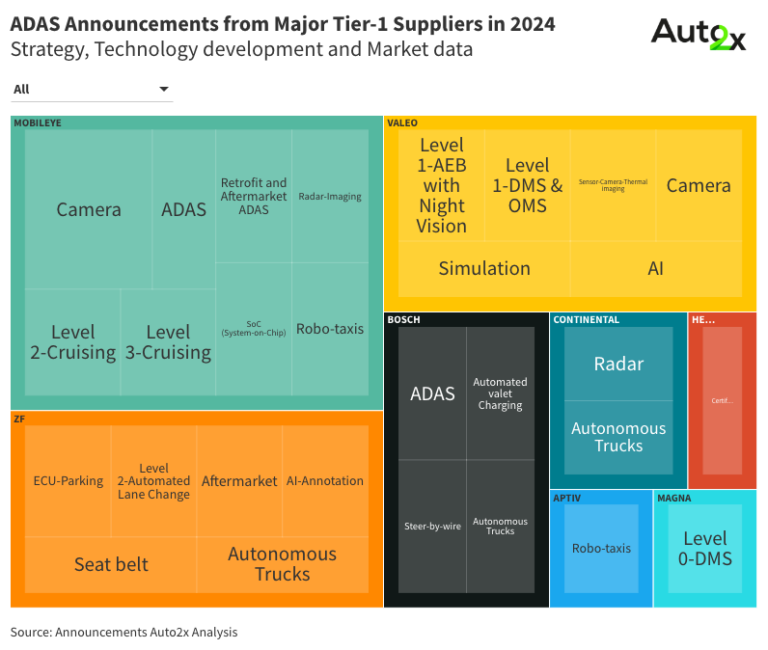

See how we have analysed the Readiness of Major Tier-1 Suppliers in Level 4 Autonomous Driving.